AL Habib Islamic Digital Account

What your needs may be, we have an account to help you bank your way

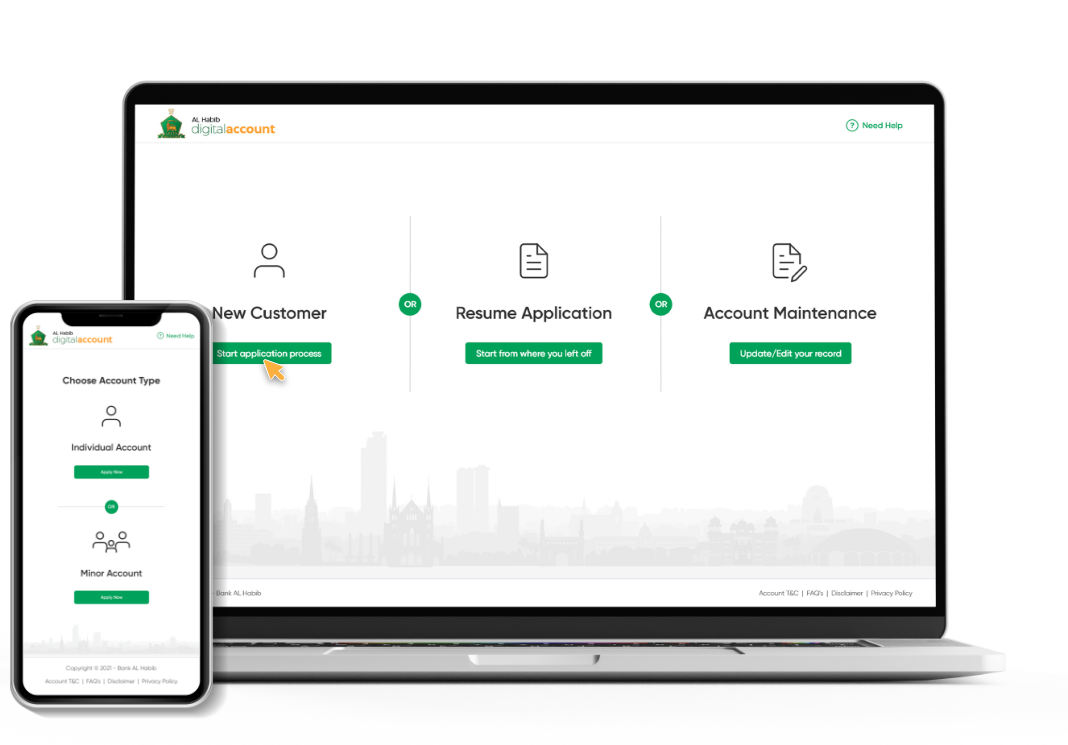

AL Habib Islamic Digital Account Opening Facility aims to redefine your account opening experience by making the process simple, easy and pleasant.

Available in

Conventional Banking

Islamic Banking

An Account for

Everyone`s Needs

Islamic Asaan Digital Account

Islamic Asaan Digital Account is an easy and convenient way to open an account digitally with minimum documentation.

Islamic Digital Account

The Islamic Digital Account provides a plethora of options to accountholders for a seamless, end-to-end banking experience.

AL Habib Islamic Remit Account

AL Habib Remit Account facilitates in receiving home remittances directly into your account.

AL Habib Woman Islamic Account

AL Habib Woman Account is a product especially designed to empower women with financial independence and facilitate them in simplified banking.

AL Habib Woman Islamic Asaan Account

AL Habib Woman Asaan Account is a product especially designed for women to empower them with financial independence and facilitate them with simplified banking.

Who can apply?

Self-employed

Employed

Unemployed

House Wife

Retired Person

Landlord

Student

Banking on the Go

There’s so much you can do with the AL Habib Mobile App

Inter Bank Funds Transfer

1Bill Facility

Generate E-Statement

Stop Cheque

Multiple Bill Payment

Frequently Asked Questions

- Who can open an account through the AL Habib Digital Account Opening Facility?

Individual Resident Pakistanis may open their account through this portal.

- What are the documents required for Account Opening?

CNIC / SNIC and Self-Declaration regarding income and profession is a mandatory document to be furnished for Account Opening.

- Which documents are required from a Minor for Account Opening purposes?

For a Minor, the following are required

- Scanned copy of:

- Juvenile Card

- Form-B

- Child Registration Certificate

- Live Photograph of Minor

- Scanned copy of:

- Is there any limit on the transactions that can be performed through these accounts?

The following limits apply on below mentioned accounts as per State Bank of Pakistan

Asaan Digital Account Credit Balance – PKR 1 Million / month Debit Balance – PKR 1 Million / month Digital Account No limit on Digital Account - Who can apply for a Debit Card?

Customers with a Rupee account may apply for a Debit Card.

- Do I have to visit the branch?

You can complete the account opening process from the comfort of your home. Even biometric verification can be completed via the AL Habib Biometric Verification app. However, if you wish to visit the branch, you may do so.

- How can I get my Biometric Verification done?

You may get your biometric verification done through the AL Habib Biometric Verification App or by visiting your nearest Bank AL Habib branch.

- Can I resume my application during account opening in case the application process abruptly halted?

Yes, you may resume the application process through “Resume Application”. After this, you will be required to input your reference number, Email Address and Mobile OTAC Verification code.

- How can I request assistance during application process?

You may call us at our dedicated helpline – (92 21) 111- 014 – 014 or email us : info-CDOB@bankalhabib.com

- Is there any minimum balance or initial deposit requirement on these accounts?

There is no minimum balance or initial deposit requirement on the aforementioned accounts.

- Which Debit Card products are available on these accounts?

You may avail the below mentioned Debit Card products (Subject to Terms and Conditions)

- PayPak Debit Card

- UPI Debit Card

- Visa Silver Debit Card

- Visa Gold Debit Card

- Visa Platinum Debit Card

For pricing of Debit Cards, you may review the Bank`s prevailing Schedule of Charges.

- Can I obtain financing against my deposits?

Yes, you may obtain financing against 90% deposits subject to Terms and Conditions

- Can I maintain any other account with the Bank if I have an Asaan Digital Account?

A customer cannot maintain any other account with the Bank if they have an Asaan Digital Account.

- Can I modify my account details without visiting the branch?

Yes you may modify your account details through the “Account Maintenance” option.

- Will I be entitled to a Statement of Account?

You may request a Statement of Account hardcopy specifically from Call Center.

- What is the turn-around time for Account Opening request acceptance or decline?

Our team will let you know within two days if the Account Opening application is accepted or declined. In case of potential decline, your case shall be referred back by the CPU Digital Desk.

- Is video-KYC mandatory?

You may receive a video call link via email from Bank AL Habib for further details/verification in accordance with the regulations of the State Bank of Pakistan. Bank AL Habib will never call from (+92 21) 111-014-014 or any other number asking for your personal information, internet/mobile banking User ID, Password, Debit/Credit Card number, PIN, OTP or CVV.

- Do I have to accept Bank AL Habib`s terms and conditions of Account Opening at stage?

Yes, a customer must accept Terms & Conditions before proceeding further with the application.

- Is there a Key Fact Sheet for Conventional and Islamic banking products being offered under AL Habib Digital Account Opening Facility?

Yes, you may review the key fact sheet for Conventional & Islamic banking products by clicking here.

- KFS for AL Habib Asaan Digital Current Account

- KFS for AL Habib Asaan Digital Savings Account

- Key Facts for AL Habib Islamic Digital Current Account (PKR Variant)

- Key Facts for AL Habib Islamic Digital Savings Account (PKR Variant)

- Key Facts for AL Habib Islamic Digital Current Account (FCY Variant)

- Key Facts for AL Habib Islamic Digital Savings Account (FCY Variant)